In the realm of financial security, insurance stands as a crucial safeguard against the unexpected. It provides a shield of protection, easing the burden of unforeseen events. Yet, within the realm of insurance lies a complex web of costs, not always immediately apparent. It is essential to comprehend the full extent of these costs to make informed decisions. This brings us to the realm of hidden or sneaky fees within insurance – charges that often lurk beneath the surface, eluding our attention. In this exploration, we will delve into these concealed costs, unraveling their nature and impact, ultimately empowering you to navigate the intricate landscape of insurance with clarity and foresight.

Types of Insurance Sneaky Fees

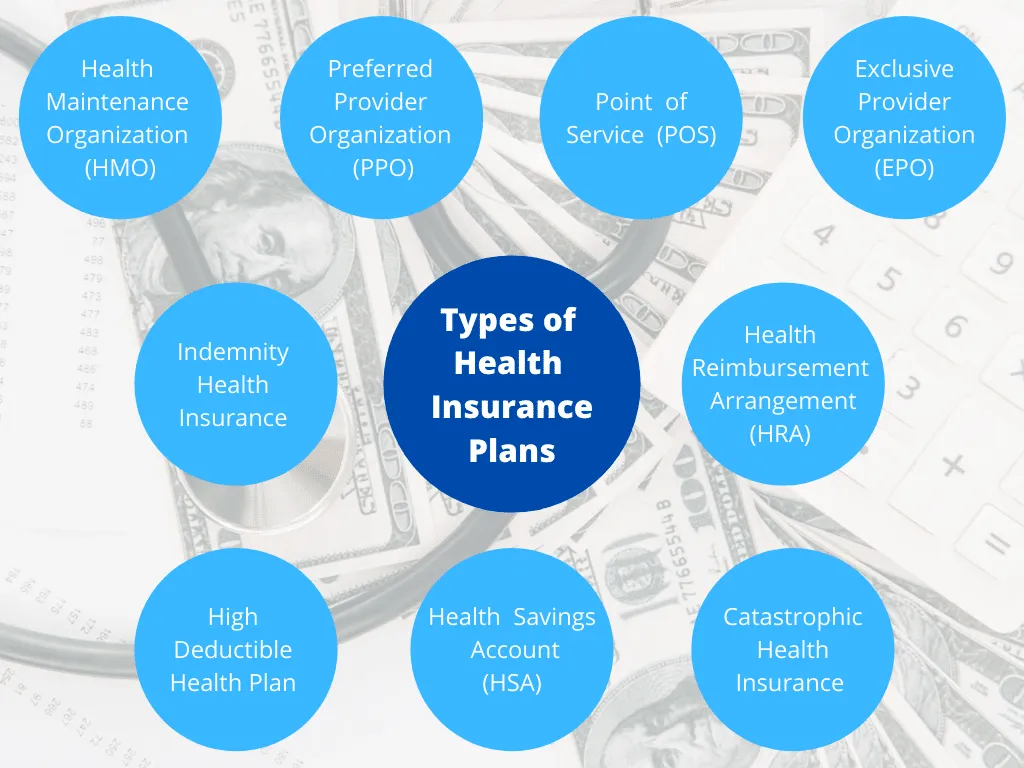

As we venture deeper into the world of insurance, it becomes evident that some fees are adept at hiding in plain sight, catching even the most vigilant consumers off guard. One such category is policy initiation fees. These fees, incurred at the onset of a policy, are often introduced subtly, buried in fine print or overshadowed by attention-grabbing marketing. Underwriting fees, too, fall into this category – charges essential to the evaluation of risk but not always adequately communicated to policyholders.

Another elusive cost arises in the form of premium loading charges. While premiums themselves are expected, these additional fees can be imposed without clear explanation, driving up the overall cost of coverage. Furthermore, the role of brokers and agents, while valuable in assisting customers, introduces the potential for undisclosed commission charges that contribute to the final price of the policy.

Administrative costs, seemingly innocuous yet influential, add to the intricate fee structure. Processing fees, for example, come to life when policies are modified or claims are processed. Similarly, paperwork charges, which might seem outdated in today’s digital age, persist and often remain camouflaged until the moment they affect your wallet.

Concealed Administrative Costs

Beneath the surface of insurance transactions lie administrative costs, seemingly minor yet capable of accumulating into significant expenses. Processing fees, one form of these concealed costs, emerge when policies undergo modifications or when claims are filed. These charges, often obscured within policy documents, contribute to the overall financial burden of insurance.

Intriguingly, even as the world turns digital, paperwork charges persist as another layer of hidden fees. In an era of online transactions, the notion of paperwork fees might seem archaic, yet they endure, occasionally making an appearance when least expected. These charges, concealed within the fine print, can impact policyholders who might assume that digital dealings are devoid of such expenses.

Within these administrative costs, there exists a paradox – seemingly routine tasks bear additional costs that, when aggregated across a customer base, generate substantial revenue for insurers. As we journey deeper, the importance of vigilance becomes apparent, urging us to scrutinize the details that often evade casual observation. By unveiling these concealed charges, we equip ourselves with the ability to make more informed decisions when engaging with the realm of insurance.

Deceptive Renewal Rates

Navigating the landscape of insurance involves more than just the initial purchase; it requires an ongoing awareness of renewal rates. Renewal rates, however, can be a realm of deception, where seemingly stable premiums undergo unexpected hikes. This phenomenon challenges the assumed continuity of cost and exposes a potential gap in communication.

Renewal rates represent a relationship between insurer and policyholder that goes beyond the inception of coverage. They signify an ongoing commitment to provide financial security. Yet, beneath the facade of familiarity, renewal rates can morph into unwelcome surprises. These increases often come with limited explanation or prior notification, leading to a disconcerting experience for policyholders.

While some rate hikes may indeed be justified, the absence of transparent communication erodes the trust necessary for a harmonious insurance relationship. As consumers, understanding this dynamic is paramount, allowing us to anticipate and question the motives behind renewal rate fluctuations. Through this understanding, we reclaim a degree of control and establish a more balanced partnership with insurers.

The Importance of Full Disclosure

In the intricate dance between insurers and policyholders, trust and transparency are the cornerstones of a harmonious relationship. The significance of full disclosure in the realm of insurance cannot be overstated. The hidden fees and concealed costs that often arise in insurance transactions erode this foundation of trust.

Clear and comprehensive communication, bolstered by full disclosure, is the backbone of informed decision-making. When insurers fail to provide a complete picture of the costs involved, consumers are left vulnerable to surprises that impact their financial planning. The lack of transparency can lead to feelings of betrayal, as policyholders discover unexpected charges that were never fully revealed.

Full disclosure empowers consumers to grasp the entirety of their financial commitments, enabling them to make choices that align with their needs and budgets. It allows policyholders to evaluate not only the apparent benefits of coverage but also the underlying costs that might otherwise remain hidden until it’s too late.

Tips for Consumers

Empowerment in the realm of insurance begins with informed decision-making. To navigate the intricacies and potential pitfalls, consider these practical tips:

- Read Policy Documents Thoroughly: Devote time to understanding the policy terms, conditions, and the fine print. Every detail matters, especially when it comes to hidden fees.

- Ask the Right Questions: Don’t hesitate to ask your insurer about any potential fees, charges, or increases in costs. Seek clarity on the specifics of the policy and any potential hidden expenses.

- Compare Quotes and Research Insurers: Don’t settle for the first quote you receive. Compare offers from multiple insurers, looking beyond the premium to uncover any hidden charges.

- Seek Third-party Opinions and Reviews: Tap into the experiences of others. Online reviews and discussions can provide insights into potential pitfalls and unmentioned costs.

- Utilize Online Calculators and Tools: Leverage online tools to estimate the true cost of insurance, factoring in possible hidden fees. These tools can offer a more realistic view of the financial commitment.

Conclusion

In the intricate tapestry of insurance, understanding the hidden threads that weave through policies is essential for making sound financial decisions. The concept of hidden fees and concealed costs is not meant to foster skepticism, but rather to inspire vigilance. By delving into the nuances of policy initiation fees, underwriting charges, and administrative costs, we’ve shed light on the importance of thorough comprehension.

Leave a Comment

Instagram