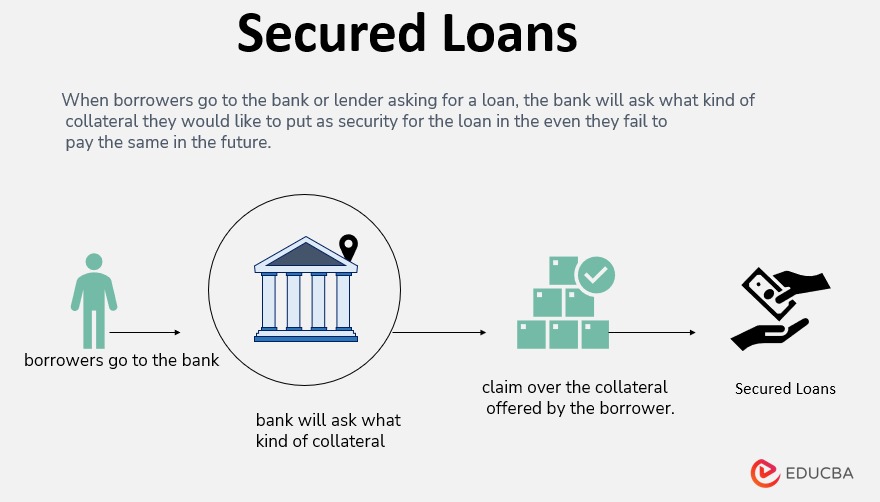

In the realm of lending and borrowing, collateral and secured loans play pivotal roles. Collateral refers to the valuable assets or property that a borrower pledges to a lender as security against a loan. Secured loans, on the other hand, are loans that are backed by this collateral. This arrangement provides a layer of protection for lenders and can significantly impact various aspects of the loan agreement. Let’s delve deeper into the significance of collateral in secured loans.

Types of Collateral

Collateral can encompass a range of assets, each offering tangible value to secure a loan. These assets can be broadly categorized into three main types: real assets, financial assets, and personal assets.

Real assets involve tangible properties such as real estate, vehicles, and equipment. These items hold inherent value and can be reclaimed by the lender if the borrower defaults.

Financial assets comprise stocks, bonds, and savings accounts. These assets hold a measurable market value and can be used as collateral to secure a loan.

Significance of Collateral in Secured Loans

The presence of collateral in secured loans holds profound significance for both borrowers and lenders. It fundamentally serves as a safeguard that influences various facets of the loan arrangement, ultimately shaping the borrowing experience.

For lenders, collateral acts as a buffer against potential financial loss. It provides a tangible source of recourse in case the borrower defaults on the loan, enabling the lender to recover a portion of the outstanding amount by selling the pledged assets.

Moreover, the presence of collateral can lead to more favorable loan terms for borrowers. Lenders are often inclined to offer lower interest rates, higher loan amounts, and more flexible repayment periods due to the reduced risk associated with secured loans.

Loan-to-Value (LTV) Ratio

The Loan-to-Value (LTV) ratio is a pivotal concept intimately connected with collateral-backed loans. This ratio quantifies the relationship between the loan amount and the appraised value of the pledged collateral. It serves as a critical tool for lenders to assess the level of risk associated with a secured loan.

LTV ratio calculation involves dividing the loan amount by the appraised value of the collateral and then expressing it as a percentage. This figure provides a clear understanding of how much of the loan is secured by the underlying asset. A lower LTV ratio indicates a higher level of security for the lender, as a larger portion of the loan is covered by the collateral’s value.

The LTV ratio profoundly impacts the approval process and the terms of the secured loan. A lower LTV ratio often results in more favorable loan terms, such as lower interest rates and a higher likelihood of loan approval. Conversely, a higher LTV ratio might lead to stricter terms or even loan denial due to the increased risk for the lender.

Collateral Management and Valuation

Collateral management and valuation are intricate components within the realm of secured loans, bearing substantial weight in ensuring a fair and effective lending process.

Accurate valuation of collateral is paramount. It involves a meticulous assessment of the pledged assets’ market value, often conducted by professionals with expertise in appraisals. This valuation determines the collateral’s worth, influencing the loan amount that can be secured against it.

Effective collateral management extends beyond initial valuation. Lenders continuously monitor the collateral’s value during the loan term to ensure it aligns with the outstanding balance. This proactive approach helps safeguard the lender’s interests and ensures that the asset remains sufficient security throughout the lending period.

Collateral Default and Repossession

Collateral default and repossession form a critical aspect of the secured loan dynamic, outlining the potential consequences when borrowers are unable to meet their obligations.

If a borrower defaults on a secured loan – meaning they fail to meet the agreed-upon repayment terms – the lender has the legal right to initiate the repossession process. This involves seizing the pledged collateral to recover the outstanding debt. Repossession, however, is typically considered a last resort, as lenders generally prefer to work with borrowers to find alternative solutions.

The repossession process varies based on jurisdiction and the type of collateral. Legal requirements must be adhered to, ensuring a fair and transparent process. Once the collateral is repossessed, it may be sold to recover the outstanding debt. Any surplus funds from the sale are returned to the borrower, though if the sale doesn’t cover the entire debt, the borrower may still be liable for the remaining balance.

Alternatives to Collateral-Based Lending

In the realm of lending, collateral-based approaches are not the sole option available to borrowers. Several alternative avenues exist that cater to varying financial needs and risk profiles.

Unsecured loans, for instance, do not require collateral but rely heavily on a borrower’s creditworthiness. These loans often come with higher interest rates due to the increased risk for lenders.

Personal lines of credit provide borrowers with a flexible borrowing arrangement, allowing them to access funds up to a predefined limit. Collateral might not be mandatory, but terms depend on the borrower’s credit history.

Conclusion

In the intricate realm of secured loans, collateral emerges as a cornerstone, shaping the dynamics of lending and borrowing. The interplay between collateral and secured loans offers a multi-faceted landscape with far-reaching implications.